The required disclosures vary by accounting standard (e.g. IFRS 17, US GAAP or local) and may be prescribed by prudential regulators. For example, insurers based in Europe are subject to the Solvency II regime, which requires extensive regular reporting.

Despite the high volumes and complexity involved, many insurers rely on manual processes involving a combination of spreadsheets and text editors such as MS Excel and Word when preparing their financial reports. These processes demand significant effort in transferring data, creating and updating links, tables and charts, and drafting commentary. While these tools are flexible and intuitive, enabling collaboration within and across departments, using them as part of a reporting process is time-consuming and prone to errors.

THE GROWING COMPLEXITY OF THE REPORTING LANDSCAPE COMPOUNDS THESE CHALLENGES

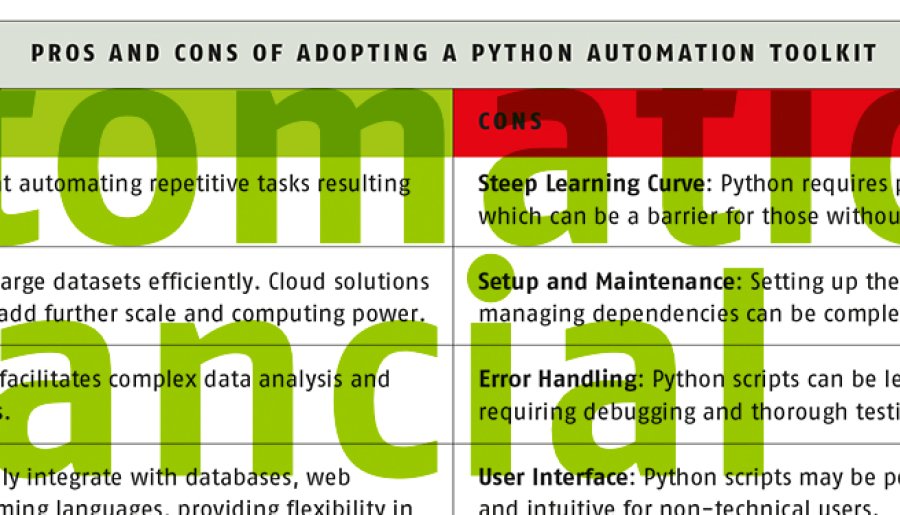

Process automation offers insurers an opportunity to reimagine financial reporting. By adopting automation, insurers can significantly reduce the time spent preparing financial reports and free up time of skilled experts for more value-adding analysis.

This article first examines how financial reporting is performed

manually and how it can be automated using an open-source Python

toolkit. It then compares the pros and cons of both approaches before

presenting conclusions.

Read the article under Download.

Download

- Automation of financial reporting .pdf • 0,05 MB